By O. Kay Henderson (Radio Iowa)

Governor Kim Reynolds is calling for another reduction in Iowa’s personal income tax and a 50% increase in the minimum salary for first-time teachers.

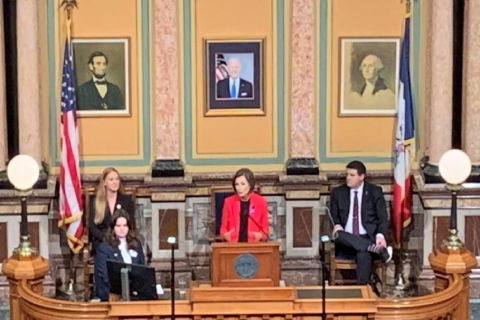

Reynolds delivered the annual “Condition of the State” address tonight and outlined her priorities for legislators. The governor proposes a $50,000 starting salary for Iowa’s rookie teachers.

“We want younger Iowans to see the teaching profession as something to aspire to. It’s one of the highest callings one can have,” Reynolds said, “so let’s make sure that teacher pay sends that message.”

The governor wants state law to require a minimum salary of $62,000 for teachers with at least a dozen years of experience. “These investments will put Iowa in the top five states for starting pay and help recruit more of the best and brightest to join the teaching profession,” she said and lawmakers from both parties applauded.

Reynolds is proposing two tax cuts. Businesses would pay half as much per employee into the state fund used to pay unemployment benefits. “Instead of paying money into the government these businesses can create more jobs, increase salaries or reinvest into their communities,” Reynolds said.

And Reynolds proposes deeper cuts in the state’s personal income tax — a retroactive cut to January 1 of this year and lowering the rate to 3.5% in 2025.

“You know it wouldn’t be a Condition of the State address without me talking about your money or, as the government calls it, taxes,” Reynolds said near the end of her speech. “…Let’s not hestitate. Let’s stick to the approach we established in 2018 and allow Iowans to keep more of their money.”

The governor is proposing a major overhaul of the nine Area Education Agencies. “While some of our AEAs are doing great work, others are underperforming,” she said.

Iowa spends more than the national average to educate students with disabilities, but their test scores are below average. “No system, however long-standing, is above reform,” Reynolds said.

She proposes ending training and other education services from the AEAs and making special education their only focus. School districts would no longer have to forward all special education funding to the AEAs and could choose to that money to hire their own staff, contract with a private firm or pay the AEA for special ed services.

“We’re not reducing special education funding by one dime,” Reynolds said. “We are simply giving control of the funding to those who work directly with your child on a daily basis and taking special education off autopilot.”

The governor covered a number of other topics in her speech. Reynolds is asking lawmakers to tighten rules that forbid foreign ownership of more than 320 acres of farmland, to force disclosure if foreign interests are part of companies that own farmland. She’s also renewed her request that lawmakers extend Medicaid coverage for new moms for a full year. The limit for post-pregnancy check-ups is currently 60 days for women who qualify for government-paid insurance.

GOP leaders in the legislature say cutting taxes is a goal they share with Governor Reynolds, but it’s unclear if the tax plan she outlined in her annual address to lawmakers will sail through the House and Senate. House Speaker Pat Grassley said his first impression is the governor has made reasonable recommendations, but he told reporters House Republicans will examine the full impact over the next two years.

“I like the agenda she laid out when it comes to tax policy,” Grassley said after the speech, “and we look forward to fully engaging as we see what those out years look like.”

Last year, Senate Republicans proposed a bill to eliminate the state income tax by the end of this decade, but Senate Republican Leader Jack Whitver said the governor’s plan for a 3.5% flat income tax rate by 2025 may be an interim step.

“The goal is to get to zero in the state of Iowa,” Whitver said. “Whether we get here in year one (or) year 10, we don’t know, but taking another step forward is certainly progress that we appreciate.”

House Democratic Leader Jennifer Konfrs said about half a million Iowans do not owe any income taxes to the state and the proposed cuts don’t help them. “We didn’t hear anything tonight about affordable housing, about child care, about utilities,” Konfrst said. “Costs are more about income taxes.”

Grassley said there’s interest in both parties in the governor’s plan to raise teacher salaries. “The governor’s been very clear over the last several months that was going to be something she wanted to look at as we came into the legislative session,” Grassley said tonight. “I think you’re going to see a lot of interest in wanting to do something when it comes to getting us into those higher levels.”

Konfrst said Democrats have for years supported raising teacher salaries, but they need more details. “We have a lot of questions, of course,” Konfrst said. “We want to know about the paraprofessionals and other professionals in the school, some of whom are earning less than $10 an hour.”

Whitver said Senate Republicans are interested in setting a higher minimum salary for beginning teachers and they’ll see how the governor’s proposal fits in the overall state budget. Reynolds said her teacher pay plan has a $96 million price tag.